Mortgage Broker Average Salary - Questions

Wiki Article

Everything about Mortgage Broker

Table of ContentsThe Main Principles Of Mortgage Broker Assistant Job Description Some Known Details About Broker Mortgage Near Me Getting My Mortgage Broker Assistant Job Description To WorkBroker Mortgage Meaning for DummiesThe Greatest Guide To Mortgage Broker Vs Loan Officer7 Simple Techniques For Broker Mortgage RatesThe 25-Second Trick For Mortgage Broker Average SalaryThe Ultimate Guide To Mortgage Brokerage

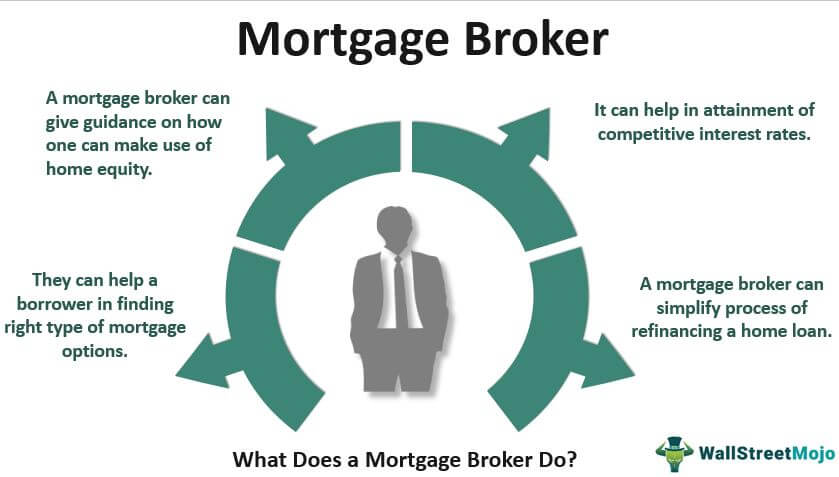

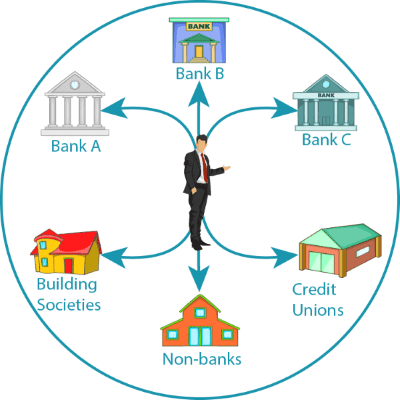

A broker can contrast car loans from a bank and a credit union. According to , her initial obligation is to the organization, to make certain loans are properly secured and also the consumer is absolutely qualified and will make the funding repayments.Broker Compensation A mortgage broker stands for the debtor a lot more than the loan provider. His obligation is to get the consumer the ideal offer feasible, no matter the institution. He is normally paid by the funding, a type of compensation, the difference in between the rate he receives from the loaning institution and also the price he offers to the borrower.

The smart Trick of Mortgage Brokerage That Nobody is Talking About

Jobs Defined Recognizing the pros and cons of each may aid you determine which occupation course you wish to take. According to, the main difference between both is that the bank home loan police officer represents the items that the bank they work for offers, while a home mortgage broker collaborates with multiple loan providers as well as works as an intermediary in between the lending institutions and client.On the various other hand, bank brokers may find the job mundane after a while because the procedure usually remains the exact same.

Rumored Buzz on Mortgage Broker Salary

What Is a Financing Police officer? You may recognize that locating a loan officer is an important action in the procedure of acquiring your car loan. Let's review what car loan officers do, what expertise they need to do their job well, as well as whether loan police officers are the very best option for borrowers in the financing application screening procedure.

A Biased View of Mortgage Broker Association

What a Loan Policeman Does, A finance police officer works for a bank or independent lending institution to assist customers in looking for a finance. Since numerous consumers deal with finance police officers for home mortgages, they are often referred to as mortgage policemans, however lots of financing police officers aid debtors with various other fundings also.A funding policeman will consult with you as well as assess your creditworthiness. If a lending police officer thinks you're qualified, after that they'll advise you for approval, and also you'll have the ability to continue in the procedure of acquiring your car loan. 2. What Lending Police Officers Know, Finance policemans have to be able to function with consumers and also little company proprietors, as well as they should have comprehensive expertise about the sector.

Not known Factual Statements About Mortgage Broker Meaning

4. Just How Much a Car Loan Police Officer Prices, Some lending officers are paid via payments. Mortgage tend to cause the biggest compensations due to the size and work linked with the lending, but commissions are often a flexible pre-paid charge. With all a loan police officer can do for you, they have a tendency to be well worth the price.Lending policemans recognize all about the numerous types of loans a lending institution might supply, and they can give you suggestions regarding the finest choice for you as well as your scenario. Review your requirements with your loan officer.

The 5-Second Trick For Mortgage Broker Salary

The Duty of a Funding Police Officer in the Testing Refine, Your finance officer is your direct get in touch with when you're using for a loan. You won't have to fret regarding routinely calling all the individuals included in the home mortgage loan process, such as the expert, real estate agent, settlement lawyer and also others, because your car check that loan policeman will certainly be the factor of call for all of the included celebrations.Since the process of a financing purchase can be a complicated as well as pricey one, several customers prefer to collaborate with a human being rather than a computer system. This is why financial institutions may have a number of branches they want to serve the potential consumers in different areas that want to meet face-to-face with a funding police officer.

The Basic Principles Of Mortgage Broker Meaning

The Duty of a Lending Policeman in the Funding Application Refine, The mortgage application a fantastic read procedure can feel overwhelming, particularly for the new buyer. When you function with the appropriate car loan policeman, the procedure is in fact rather basic. When it involves looking for a home loan, the procedure can be broken down into 6 stages: Pre-approval: This is the stage in which you locate a finance police officer and get pre-approved.During the lending handling stage, your car loan policeman will contact you with any kind of concerns the lending processors might have regarding your application. Your funding policeman will then pass the application on the expert, who will evaluate your creditworthiness. If the underwriter approves your financing, your lending officer will certainly then collect as well as prepare the suitable lending shutting files.

Some Known Details About Broker Mortgage Meaning

So exactly how do you select the appropriate car loan policeman for you? To begin your search, start with loan providers that have a superb online reputation for surpassing their consumers' assumptions and also keeping sector standards. Once you've chosen a lender, you can after that start to tighten down your search by speaking with finance police officers you might wish to deal with (broker mortgage rates).

Report this wiki page